As the budget season begins for the public schools, the importance of taxable property valuations becomes evident.

North Platte residents are receiving notices of property valuations, and the school district is awaiting the total preliminary valuation of property in the district, which will help determine how much income the district will have in the next school year.

The preliminary district-wide valuation total is expected any day.

North Platte Public School District Finance Director Stuart Simpson discussed the situation with the school board during the board’s meeting on June 10.

Simpson said in the 2023-24 school year, 43% of district revenue came from property taxes.

He also said that 80% of expenditures are directly allocated to student instruction.

Simpson also noted that, at this time of the school year, the district should have spent 75% or less of budgeted expenditures. He said actual expenditures average less than that — 63.75%.

Referring to a budget summary that Simpson provided, school board President JoAnn Lundgreen noted that property tax income went from $10 million in 2018-19 to $16.2 million in 2023-24, while state aid increased a little, from $8.2 million to $8.8 million, over the same years

Pointing to the budget summary, Lundgreen asked what were the “state sources” of revenue on the budget summary. That is a different category of income than state aid.

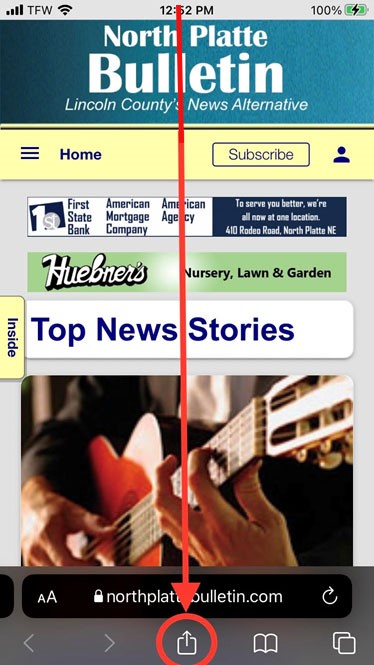

Tap image to enlarge

Simpson said most of the income from state sources are payments for special education.

In 2018-19, state sources brought in $3.6 million, which increased to $7.1 million in 2023-24.

Lundgreen also asked what the “county sources” were, and Simpson said that is income from fines and licenses. In 2018-19, county sources generated $180,332, and by 2023-24, that increased to $228,429.

Board member Angela Blaesi asked about the “other income” category. Simpson said that is any revenue that is not tied to other categories of revenue.

Simpson said last year, the total property valuations in the school district increased 10%, although the preliminary valuation only predicted an 8% increase. He said once the county certified the valuations, the amounts were sent to the Nebraska property tax assessment division. He said state requirements must be met, and the state property tax assessment division adjusted the county’s valuations accordingly. Last year, the state increased property valuations from 8% to 10%, or by $24 million.

Simpson said when valuations go up, state aid goes down. He said this year, the final, certified valuations will not come from the county assessor until Aug. 20, not long before the notices of a joint tax hearing (pink postcard) must go out (Sept. 4 or 5). The postcards notify property owners that their taxes will increase under the budgets of schools, cities, counties, etc. Then, a joint hearing is held so taxpayers can voice their opinion of the increase, just before the budgets are finalized.

When it comes to how much schools can tax and comply with the state’s spending lid and levy limit, Simpson said the school district’s total property “tax request authority” in 2024-25 is $29.4 million, a decrease of $509,381 from last year’s $29.9 million.

Looking back at a board decision made last year, Simpson said if 70% of the board (5 of 6 members) would have agreed to an additional growth percentage, the district would now have $31.7 million in property tax authority.

Simpson said he did some rough calculations, and the district needs to stay under $31.16 million in its property tax request to avoid facing taxpayers at the joint budget hearing (the “pink card hearing.”)

Board member Skip Altig said most people know the school district budget is discussed every month and the school board sets the final budget. Altig said most people think the board sets the property valuations, but they do not; the county assessor sets them.

Altig also reiterated that when valuations go up, state aid decreases, increasing property tax requests.

Board member Cindy O’Connor agreed with Altig and said many people have asked her about the valuations. O’Connor said the school board’s hands have been tied with state aid because it has gone down as valuations have gone up, resulting in an increase in property tax requests.

O’Connor said she feels the pain and will work hard to make it better for everyone.

Board member Angela Blaesi said she is a homeowner and understands that everything is going up. She is also a business owner, so she understands that things must be cut, and frivolous purchases removed from budget plans. Blaesi said the board needs to show where they are trimming the fat, if a tax raise is required.

Board member Matt Pederson reiterated that the board does not set the valuations. Pederson reminded the public that nothing was done about property taxes in the legislature, so they are stuck with the old system. Pederson said even though everyone wants to pay as little in taxes as possible, the board has a constitutional duty to educate students and provide them with free education.

Vice-president Emily Garrick said the board is discounting their abilities and powers in setting the property tax requests. She said that while the board does not set valuations, it is up to the board to find a suitable budget once the valuations are set.

Garrick read the board’s policy (3001) on increases in property valuations, which says, “If the annual assessment of property would result in an increase in the total property taxes levied as determined using the previous year’s rate of levy, the district’s property tax request for the current year shall be no more than its property tax request in the prior year, and the district’s rate of levy for the current year shall be decreased accordingly when such rate is set by the county board of equalization.”

Garrick said as a board, they set this policy, and it is their job to follow it. She said that, according to the policy, they have the power to help reduce the crunch that all taxpayers are feeling. Garrick said if valuations go up, the levy should go down, so the district receives the same amount of taxes from taxpayers. Garrick said they have a lot of power, as the largest taxing entity in Lincoln County.

Garrick said the board should look at what they need to provide a great learning environment for the students, what impact these things have on student learning, and work up from there, rather than looking at the maximum amount of dollars that the district can tax the community without having a hearing, and then working backward.

Garrick said they will continue being pressured by the state to take responsibility. She feels some of the community is leaning towards the presented taxing options, such as the EPIC tax proposal. If the board does not take responsibility, they will have more than just a budget to deal with.

Lundgreen said the board’s discussion helps make the public aware of the situation.

She said Gov. Jim Pillen is pushing the legislature to cut property taxes by 40%. Lundgreen agrees that everyone needs to do their part and hopes the state will also step up and do its part. She feels the state is pointing fingers at the schools and not taking any responsibility.

Lundgreen said historically, the state has yet to carry its share of responsibility to fund public schools. For a long time, Nebraska was ranked 49th in the U.S. in the amount of state aid to schools. Lundgreen said the district is ready for growth, but with growth, some hard decisions may come.

She asks that the public pay attention so that when changes come, nobody is caught by surprise.

(George Lauby contributed to this report.)

© 2024 The North Platte Bulletin. All rights reserved.

Log in to post Talk Back